Dublin, June 18, 2025 (GLOBE NEWSWIRE) -- The "Ferrovanadium Market by Application, Grade, Source, End Use Industry, Form - Global Forecast to 2030" has been added to ResearchAndMarkets.com's offering.

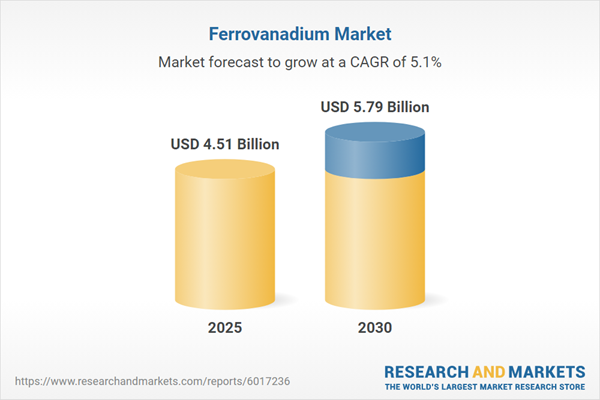

The ferrovanadium market is projected to grow from USD 4.51 billion in 2025 to USD 5.79 billion by 2030, driven by its integral role in enhancing high-performance steel. The market is evolving rapidly, driven by innovation in metallurgy and strategic alloy designs.

Transformative Shifts in Technology and Regulation

Technological advancements and regulatory changes are profoundly influencing the ferrovanadium market. The expansion of electric arc furnaces is altering consumption patterns, while producers focus on refining processes to deliver high-purity alloys essential for aerospace and battery systems. Concurrently, vanadium-based redox flow batteries are diversifying the application spectrum within the energy storage sector. Regulatory frameworks, emphasizing reduced emissions and onshore production, motivate steelmakers to pursue cleaner production pathways. Strategic partnerships and a circular economy approach are increasingly imperative to sustain competitiveness amidst these changes.

Tariff Dynamics and Their Impact on Trade

The introduction of tariffs on ferrovanadium imports to the United States in 2025 has significantly influenced the industry. This tariff adjustment has driven domestic producers to enhance capacity utilization, while international suppliers explore new trade agreements. As the U.S. market achieves greater price stability, albeit at elevated baselines, companies face challenges in alloy management strategies. Strategic procurement adjustments by downstream sectors are also notable, demonstrating how tariff policies can shape market dynamics. This focus on domestic supply chains may result in increased competitiveness and reduced dependency on imports. Decision-makers must navigate these complexities to maintain a balance between resilience and cost management.

Key Takeaways from This Report

- Regulatory developments and technological advancements are steering the market towards sustainable practices and innovative applications.

- Diverse applications across industries, including aerospace and automotive, highlight the varied demand drivers influencing this market.

- Regional dynamics and competitive strategies play a crucial role in shaping the market's supply, demand, and pricing structures.

- Understanding tariff impacts and fostering collaborations are essential for companies aiming to capture value and ensure operational agility.

Competitive Landscape and Strategic Imperatives

Competition in the ferrovanadium sector spans global mining conglomerates to specialized alloy producers. Vertical integration and strategic collaborations are key trends, with companies investing in low-carbon smelting technologies and forming alliances with battery developers. Quality assurance and traceability systems differentiate leading firms, enabling them to meet stringent material specifications. This competitive terrain necessitates resilience, innovation, and collaboration, ensuring robust supply chain management and energy-efficient production processes. By co-developing tailored solutions with end-users, particularly in the rapidly evolving battery and aerospace sectors, companies can secure higher margins and foster long-term customer loyalty.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 196 |

| Forecast Period | 2025-2030 |

| Estimated Market Value (USD) in 2025 | $4.51 Billion |

| Forecasted Market Value (USD) by 2030 | $5.79 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

Key Topics Covered

1. Preface

1.1. Objectives of the Study

1.2. Market Segmentation & Coverage

1.3. Years Considered for the Study

1.4. Currency & Pricing

1.5. Language

1.6. Stakeholders

2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Market Sizing & Forecasting

5. Market Dynamics

6. Market Insights

6.1. Porter's Five Forces Analysis

6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Ferrovanadium Market, by Application

8.1. Introduction

8.2. Chemical Industry

8.2.1. Catalyst

8.2.2. Redox Flow Battery

8.3. Foundry

8.3.1. Iron Foundry

8.3.2. Steel Foundry

8.4. Steel Production

8.4.1. Basic Oxygen Furnace

8.4.2. Electric Arc Furnace

8.4.3. Induction Furnace

9. Ferrovanadium Market, by Grade

9.1. Introduction

9.2. FeV50

9.3. FeV60

9.4. FeV80

10. Ferrovanadium Market, by Source

10.1. Introduction

10.2. Iron Ore

10.3. Steel Scrap

10.4. Vanadium Slag

11. Ferrovanadium Market, by End Use Industry

11.1. Introduction

11.2. Aerospace

11.3. Automotive

11.4. Construction

11.5. Pipeline

12. Ferrovanadium Market, by Form

12.1. Introduction

12.2. Lumps

12.3. Pellets

12.4. Powder

13. Americas Ferrovanadium Market

13.1. Introduction

13.2. United States

13.3. Canada

13.4. Mexico

13.5. Brazil

13.6. Argentina

14. Europe, Middle East & Africa Ferrovanadium Market

14.1. Introduction

14.2. United Kingdom

14.3. Germany

14.4. France

14.5. Russia

14.6. Italy

14.7. Spain

14.8. United Arab Emirates

14.9. Saudi Arabia

14.10. South Africa

14.11. Denmark

14.12. Netherlands

14.13. Qatar

14.14. Finland

14.15. Sweden

14.16. Nigeria

14.17. Egypt

14.18. Turkey

14.19. Israel

14.20. Norway

14.21. Poland

14.22. Switzerland

15. Asia-Pacific Ferrovanadium Market

15.1. Introduction

15.2. China

15.3. India

15.4. Japan

15.5. Australia

15.6. South Korea

15.7. Indonesia

15.8. Thailand

15.9. Philippines

15.10. Malaysia

15.11. Singapore

15.12. Vietnam

15.13. Taiwan

16. Competitive Landscape

16.1. Market Share Analysis, 2024

16.2. FPNV Positioning Matrix, 2024

16.3. Competitive Analysis

16.3.1. Glencore PLC

16.3.2. AMG Advanced Metallurgical Group N.V.

16.3.3. Tsingshan Holding Group Co., Ltd.

16.3.4. Qinghai Salt Lake Industry Co., Ltd.

16.3.5. Gansu Qiankun Vanadium & Titanium Co., Ltd.

16.3.6. Ferroglobe PLC

16.3.7. AccMet Materials, Inc.

16.3.8. Evraz PLC

16.3.9. Sichuan Chuangma Technology Co., Ltd.

16.3.10. voestalpine AG

For more information about this report visit https://www.researchandmarkets.com/r/ja81xf

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment